Find out the webinar replay of the 6 National Country Reports by Mickaël Mangot, Chief Scientific Officer “Retail and Impact Investing”, available here.

The results add on our previous research on retail investors preferences in seven EU countries (Denmark, Germany, France, Ireland, Romania, Greece and Estonia) 2DII published in 2021 (here) and 2020 (here).

Each country report is the synthesis of national results gathered from several materials:

- A quantitative survey (on a minimum of 1000 respondents per country),

- Qualitative interviews (bilateral or focus groups),

- An estimate of market potential for various green financial solutions in relation with attitudes expressed in the quantitative survey.

Here is a selection of the main results:

- A general lack of knowledge but an interest for and a positive attitude towards sustainable finance (solutions),

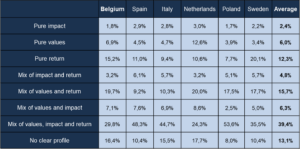

- A high level of heterogeneity in beliefs and motivations across people, with some regularities:

- In each country, between 40% and 60% of retail investors want to have impact,

- In each country, the most common profile is the “I want it all” profile (i.e., looking for returns, value-alignment and impact simultaneously).

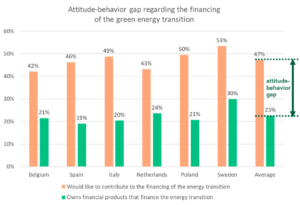

- A limited ownership of green financial solutions (between 5% and 15% for each product type),

- A significant retail attitude-behavior gap regarding the financing of the green energy transition, to be connected to the lack of knowledge, information costs and a low level in trust,

- A large variety of perceptions of what “impact funds” are but a more consensual perception about what they should be,

- Despite the recent takeoff, an untapped potential for many green retail investment solutions:

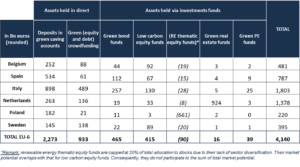

- We estimate the total market potential for the 6 EU countries to be EUR 4.1 tn for green assets held in direct or through investment funds, EUR 1.6 tn for green assets held through pension funds and EUR 0.8 tn for green assets held through life insurance,

- Therefore, ensuring that life insurance and pension funds carefully reflect their beneficiaries’ sustainability motivations is key for the full deployment of green financial solutions,

- Due to current asset allocations of households’ financial investments held in direct or via intermediaries, market potentials are often highest for deposits in green saving accounts and for green bond funds.

About our funder and the project: This project is funded by the EU’s Horizon 2020 research and innovation program under Grant Agreement No 834345. LEVEL EEI aims at making the financial products contributing to energy efficiency and sustainable energy more competitive. This work reflects only the author’s view and the funder is not responsible for any use that may be made of the information it contains.

The paper is part of the Retail Investing Research Program at 2DII which is one of the largest publicly funded research projects about the supply, demand, distribution and policy side of the retail investment market in Europe.