Find out the webinar replay of the Moving the Blockers of Retail Sustainable Finance presentation by Nicola Koch, Head of Retail Investing at 2DII, available here.

Across the EU-6 countries, main results involve:

- On the demand side: a noticeable attitude-behavior gap with positive attitudes of retail investors towards sustainable finance not being fully translated into actual ownership of sustainable financial products. Across people, beliefs and preferences regarding sustainable finance products are highly heterogeneous.

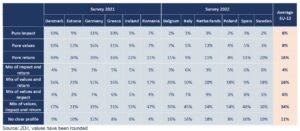

Distribution of sustainability profiles across Europe

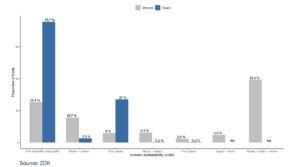

- On the supply side: an insufficient and highly concentrated offer, focusing on a few sustainable strategies only. Such a concentration does not reflect the heterogeneity of clients’ preferences and especially does not respond to the needs of impact-motivated clients. In fact, across the EU-6 countries in the scope of this analysis around 51% of retail investors had an impact objective for their investment, while we could classify only 0,2% of the market share on the Lipper database as potentially suitable for this group (solely microfinance funds). This desk-study of the Lipper fund database indicates that investor impact is still not systematically integrated in the sustainable investment value chain.[2]

Comparing demand and supply for various investor sustainability profiles (EU-6)

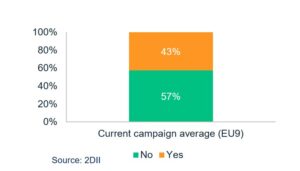

- On the distribution side: a low level of compliance with the regulatory changes requiring a mandatory assessment of client sustainability preferences during the suitability assessment. This raises concerns as to whether the intended incentive structure so that the financial product offering changes to include more sustainable financial products is really in effect. It is also questionable whether advisor sustainable finance knowledge is sufficient to provide proper advice to sustainability-oriented clients. We identified across all countries a high risk to be misadvised as impact-oriented client by financial advisors due to lacking expertise about investor impact, misleading explanations, or unsuitable product recommendations[3].

Appointments where the advisor raised the subject of sustainability preferences without any prompting[4]

Aggregately, the market reports reveal several critical areas of disfunction for the European retail market for sustainable financial products. To address those and promote integrity and efficiency in the European retail investment market, we articulate a list of five recommendations:

- Recommendation #1: carry out a coordinated review as soon as possible to assess the level of regulatory compliance with the new suitability assessment requirements and whether the procedure articulated for assessment of sustainability preferences is appropriately designed to contribute towards the policy objective of reorienting finance towards a sustainable economy.

- Recommendation 2: The ongoing comprehensive assessment of the SFDR must be used to clarify sustainable financial product categorisation and to integrate the concept of “investor impact” which should be followed by consequent amendments to the definition of sustainability preferences.

- Recommendation #3: use the upcoming measures to improve knowledge and competence of financial advisors announced under the Retail Investment Strategy to define precise and comprehensive requirements around sustainable finance knowledge and competence.

- Recommendation #4: open high impact potential “alternative” funds to retail clients and transform existing “conventional” products into higher impact versions.

- Recommendation #5: launch retail sustainable products that enable an exposure to small and local economic agents.

About our funder and the project: This project is funded by the EU’s Horizon 2020 research and innovation program under Grant Agreement No 834345. LEVEL EEI aims at making the financial products contributing to energy efficiency and sustainable energy more competitive. This work reflects only the author’s view and the funder is not responsible for any use that may be made of the information it contains.

The paper is part of the Retail Investing Research Program at 2DII which is one of the largest publicly funded research projects about the supply, demand, distribution and policy side of the sustainable retail investment market in Europe.

[1] 2DII published it’s first meta market report on the French sustainable retail investing market at the end of last year (see here)

[2] 2DII is currently conducting a comprehensive impact potential assessment of primary market products across six countries (incl. Germany, France, Spain, Sweden, Ireland and Switzerland) to identify financial product outside existing mainstream product databases which could be suitable for impact-oriented retail or semi-professional investors (based on 2DII’s new Impact Potential Assessment Framework (IPAF). Furthermore, more research is needed to assess the engagement and voting performance on sustainability topics of asset managers who are managing European retail savings (including pension and life insurance products). Yet, based on our preliminary findings, we expect only a couple of dozens primary market products to be available and suitable for impact-oriented retail or semi-professional investors. Moreover, research from Influence Map (see here) and ShareAction (see here) on the engagement and voting performance of the world’s largest asset managers indicate that it there is only a small share of public market funds managed by asset managers with credible and impactful engagement and voting performances. Therefore, we expect that the mismatch between impact-oriented investors and the product supply in the target countries is significant.

[3] See here also 2DII’s latest analysis of environmental impact marketing claims of 450 European Art 8 & 9 retail funds.

[4] The current campaign average (EU9) results refer to the latest round of mystery shopping visits targeting key bank networks in Italy, Netherlands and Spain as consolidated with previous results for Ireland, Greece, Estonia, Romania, Germany and Denmark (see here).