After several months of challenging (but fun) work and thanks to various excellent external experts, 2DII proudly announces the brand-new “MyFairMoney – The Impact Investing Podcast.” In eight episodes, we shed light on the complex field of impact investing and give guidance on how to maximize your impact as an investor. Together with our new Impact-Database on MyFairMoney [1], European impact-oriented investors now have a credible source to understand and increase the impact potential of their savings. The Podcast is available on MyFairMoney or directly on:

- Spotify

- Apple

- Goggle

Furthermore, 2DII developed a series of seven educational videos and quiz questions to help retail investors start their journey to invest their money more sustainably. We hope this “Sustainable Investing for Beginners” course will help many retail investors or financial advisors explain this complex topic in an interactive and compact format. Discover the whole series on MyFairMoney.

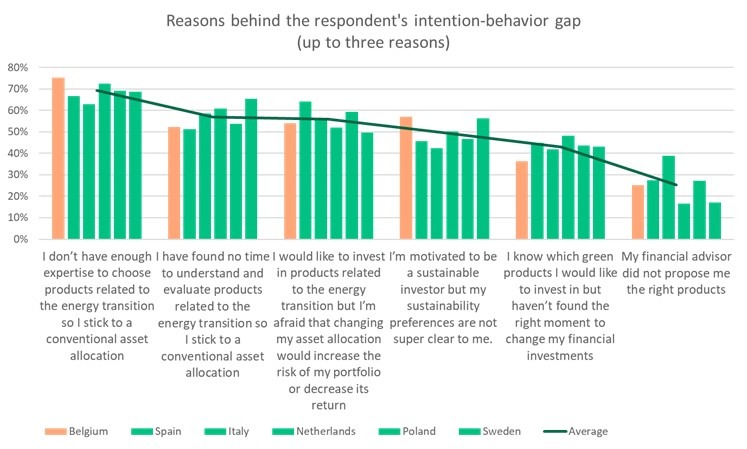

Indeed, these new educational resources are urgently needed. Several studies revealed the low level of sustainable finance literacy among European retail investors. This lack of knowledge leads to a high risk that the 60-70% of retail investors in Europe who are interested in sustainable finance are making the wrong “sustainable” investment decisions and, in turn, lose more and more of their faith in sustainable finance. As 2DII and others revealed, European retail investors are often confused by misleading financial product marketing claims or misadvised by their financial advisors [2]. Furthermore, in our surveys, over 50% of retail investors stated that the lack of expertise, the high transaction costs (in terms of time) to evaluate green products, and the fear that green investments could impair the financial performance of their portfolio were reasons why they are not investing more or not investing at all in green financial products. Moreover, in our interviews and focus groups on impact investing, European retail investors across different countries emphasized the lack of trust in financial institutions to deliver the impact of their promise and called for an independent assessment of the impact potential of their financial products.

To facilitate capital flows from private investors towards sustainable and notably impactful financial products, educational resources are key to i) increase the sustainable finance literacy of retail clients, ii) decrease information costs, and iii) build trust in sustainable finance products. We hope to have made an important step in this direction with our new educational resources.

About our funder and the project: This project is funded by the LIFE Programme and its NGOs on the European Green Deal (NGO4GD) funding program under Grant Agreement No LIFE20 NGO4GD/FR/000026.

This project is part of the Retail Investing Research Program at 2DII, which is one of the largest publicly funded research projects about the supply, demand, distribution, and policy side of the sustainable retail investment market in Europe.

[1] See myfairmoney.eu/impact-database [2] See, for instance, “Moving the blockers of retail sustainable finance“, “Jumping the barriers to sustainable retail investment in France,” and “Market review of environmental impact claims of retail investment funds in Europe.”