In this section, the phrase “contribution to climate goals,” which was initially included in Article 29, has been interpreted as being equivalent to “alignment with climate goals”. This confusion is frequent, especially in the context of the recent emergence of target setting guidelines for financial institutions.

We argue below that this kind of mix-up, especially in the context of target setting, undermines the ability of relevant legislation or protocols to make a difference in the fight against climate change.

For this reason, we recommend that these terms are always properly defined in legal or official documents, and that target setting efforts that aim to move the needle in terms of real-world emissions put the emphasis on contribution actions rather than on portfolio alignment goals.

“Alignment with climate goals” does not equate “contribution to climate goals”.

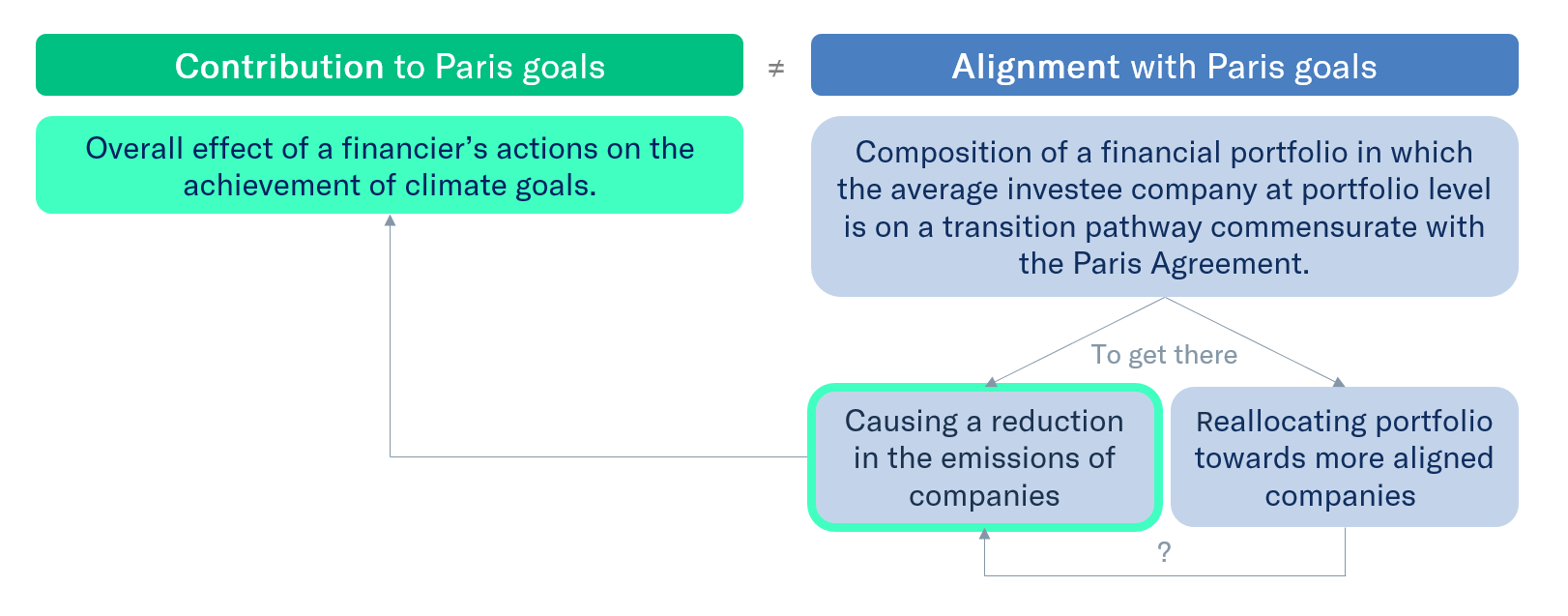

Figure 1. Contribution to climate goals and alignment with climate goals are two distinct notions.

On one hand, we consider that a financial institution’s contribution to an objective should be defined as the role the institution played in reaching the goal.

This corresponds to the dictionary definition of the term (“contribute: to be one of the reasons why something happens”). The notion of “contribution” thus implies an active participation to an effort. This definition is also aligned with the ISO 14097 (“Contribution: overall effect of a financier’s actions on the achievement of climate goals”).

Since the achievement of climate objectives is conditioned to a decrease in greenhouse gas emissions in the real economy, the term “contribution action” can be used to describe any action taken by a financial institution that aims to trigger a decrease in emissions in the real economy.

In the context of climate goals, portfolio alignment refers, in its common understanding, to the composition of a financial portfolio in which the average investee company at portfolio level is on a transition pathway commensurate with the Paris Agreement.

Two distinct types of actions can be taken by an FI that aims at reaching a portfolio alignment target:

- Shifting portfolio exposure away from “high carbon” or towards “low carbon” investee companies (e.g. selling securities issued by high-carbon companies and buying securities issued by low-carbon companies); OR

- Actively influencing investee companies to adopt “greener” business models*.

The second option for reaching a portfolio alignment target is in line with the above definition of “contribution” to climate goals: the financial institution deploys actions aimed at playing an active role in the decarbonization of the real economy.

The first option, however, does not necessarily imply a contribution to any kind of “real economy” change. Portfolio reallocations are here considered an end goal, instead of a means to trigger real world emissions reductions.

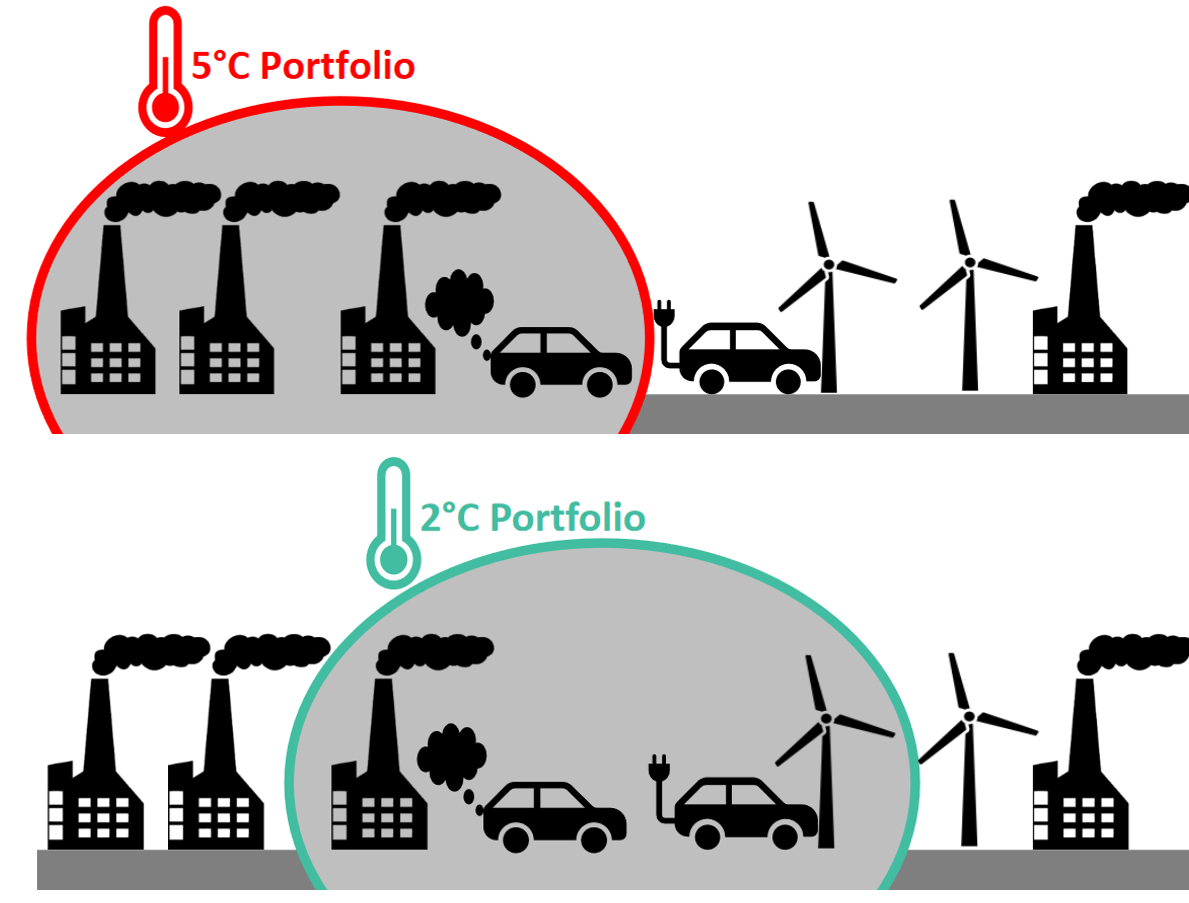

Furthermore, when they take place in secondary markets, portfolio reallocations have never been empirically associated with any change in the real economy (Kölbel et al., 2020). What this concretely means is that a financial institution can improve the “carbon footprint” of its portfolio (and thus reach its portfolio alignment target) without it contributing to any change in the real economy.

Figure 2. Portfolio alignment is not a valid proxy for GHG emission reductions in the world.

Research suggests that portfolio reallocations on secondary markets could only contribute to changes in the real economy if a very large portion of the market reallocated based on the same criteria (Heinkel et al., 2001). Even were this would happen, the changes triggered are likely to be only of limited scale (Kölbel et al., 2020).

Hence, while “alignment” targets could theoretically be reached through “contribution actions” alone, this is not necessarily a given. Chances are high that simple portfolio reallocations will be chosen over complicated contribution actions, as explained below.

“Alignment” goals are more easily reached through reallocations as opposed to more ambitious “contribution” actions.

In recent years, a growing body of literature has been exploring the means that financial institutions can use to contribute to changes in the real economy. A recent meta-analysis of this literature identifies three mechanisms that are associated with more evidence of effectiveness than other mechanisms** – especially in comparison with portfolio reallocations on secondary markets (Kölbel et al., 2020):

- Providing funding to funding-scarce, low-carbon companies or projects,

- Engaging with the companies to help them/incentivize them to grow or improve,

- Incentivizing companies to grow or improve through direct financial incentives.

Such mechanisms demand significant time and resources to be implemented properly. On top of that, their effectiveness, although empirically demonstrated in some settings, is far from systematic. This means that it may be difficult for a financial institution to reach a portfolio alignment target through contribution actions alone.

On the other hand, reaching a portfolio alignment target through portfolio reallocation is often*** much less costly and resource intensive, and its “effectiveness” in reducing the portfolio carbon footprint is certain.

It is thus likely that requiring FIs to adopt portfolio alignment targets without any further constraints as to how these portfolio alignment targets are achieved will incentivize them to reallocate their portfolios without giving thought about how they could more effectively to contribute to climate goals. As a result, regulations or initiatives that want to foster contribution to real world decarbonization should not rely exclusively on portfolio alignment targets as the means to get there.

Key takeaways.

The above-discussed elements have several implications. The conclusions below apply to the draft decree resulting from Article 29 of the Energy-Climate Law, but also to any initiative in financial markets aiming to contribute to mitigating climate change.

Use clear language. First, in legal or official documents, the terms “alignment” and “contribution” should always be clearly defined and should only be used in accordance with the definition that they were given.

Aim to contribute to real world change. Second, considering that mitigating climate change entails drastic emission reductions in the real economy, initiatives in financial markets aiming at participating in this global effort should put the emphasis on contributing to these emission reductions, as opposed to simply aligning their virtual portfolio emissions****.

Use existing evidence as guidance. Third, existing evidence regarding the effectiveness or non-effectiveness of contribution mechanisms, although incomplete, should be used in guiding the design of science-based contribution strategies. Such a scientific grounding ensures, first, that the strategy that is deployed has the best possible chances to contribute to climate change mitigation; and, second, that best practices are not discouraged. Indeed, we fear that if claiming contribution to climate change mitigation without scientific backing is permitted, no ambitious actions will ever be undertaken.

For contribution, be cautious of portfolio alignment targets. Finally, when elaborating climate targets aiming at moving the needle in terms of real-world emissions, portfolio alignment goals should be used with caution. If no further constraint on contribution is implemented, they risk incentivizing financial institutions to reallocate their portfolios without giving thought about how they could more effectively contribute to climate goals. Yet, alignment metrics can be very useful in guiding FIs to design their contribution actions, especially to identify the portfolios’ hot spots, i.e. sectors or investees to be addressed by contribution actions. In the context of risk management, portfolio alignment targets are also an important tool to consider*****.

Notes

* It can also happen that a company aligns its business model without the intervention of its financier. In this case, progress will be made towards the FI’s alignment target without it having done anything, i.e. without a contribution by the FI.

** It must be noted that, although more evidence of effectiveness is available for these mechanisms than for others, the literature on this topic is still limited. More research needs to be undertaken, especially in the case of engagement.

*** E.g. for some institutions, investment mandates might actually make portfolio reallocations harder to implement than engagement.

**** This position is in line with various recent developments at the European and international level, which testify to the growing attention paid by many financial actors to their contribution to the achievement of climate objectives, beyond their mere alignment with these objectives. For example: the factoring of impact considerations in the latest version of the Ecolabel for financial products; the description in the NZAOA target setting protocol of a theory of change based on the contribution of asset owners to real world emission reductions ; the publication of various reports by financial institutions highlighting the importance of the notion of “impact” and the limitations of portfolio alignment when it comes to delivering it (Crédit Suisse, Natixis, …); the definition of the term “contribution” given in the ISO 14097 ; etc.

***** See for example: https://2degrees-investing.org/resource/scenario-analysis-in-latin-america/

Note: This blog reflects the personal opinion of the author and not necessarily the official position of 2DII.