The financial sector is increasingly facing societal expectations and legal requirements to incorporate climate–related considerations into investment decisions. The first set of recommendations published by the Taskforce on Climate–related Financial Disclosures (TCFD) in 2017 were a pivotal moment in helping financial institutions act on climate–related financial risk. Since its publication, more than 1,700 companies, supervisors, ministries, and others have supported its uptake.

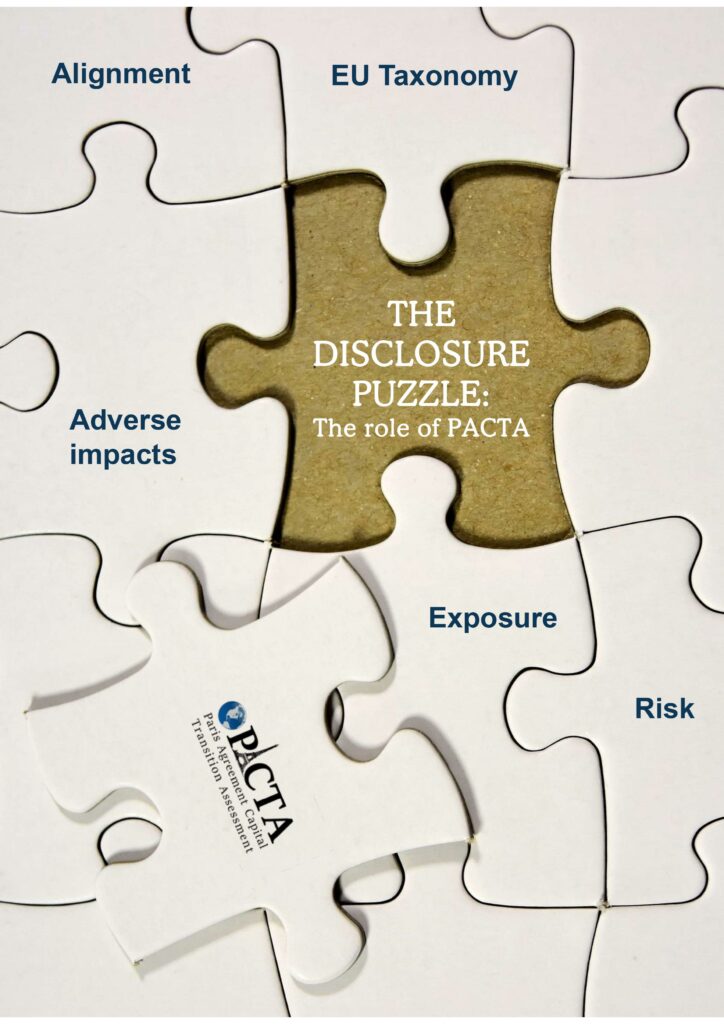

On 10 March 2021, EU financial institutions saw another milestone when Regulation 2019/2088, better known as the Sustainable Finance Disclosure Regulation (SFDR), entered into application. This regulation lays down far–reaching disclosure requirements in terms of both adverse sustainability impact (for instance, the impact your investments have on the climate) and sustainability risks (the impact sustainability factors may have on your investments). The PACTA methodology can provide information on risks, alignment and impact considerations.

At the same time, under the new EU Taxonomy Regulation, many financial institutions will be required as of 2022 to disclose whether and to what extent the financial products they offer invest into green climate–related economic activities. The delegated act that defines “green activities” will be finalized soon.

Financial institutions thus face a variety of climate–related requirements and expectations. Climate considerations will need to be integrated into the entire investment chain, and there is no one–size–fits all solution nor a one–stop shop. Financial institutions will need to engage and work with a variety for metrics to get a holistic picture. Each metric and tool can play a part and help solve pieces of the puzzle. This document gives a brief explanation of how PACTA can help you meet some of the soft and hard law climate requirements for financial institutions.