Join us to our webinar presentation on October 15th, 2024, from 15.00 to 16.00 (CET).

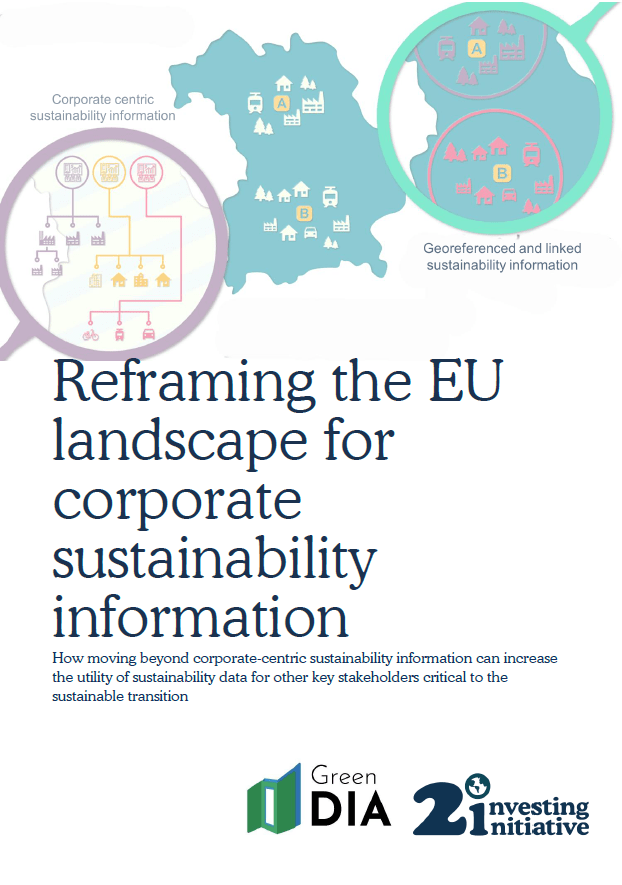

This paper advocates for reframing EU corporate sustainability reporting from a purely corporate-centric approach to a model that enhances interoperability with administrative, statistical and third-party datasets and includes georeferenced data.

More than five years after the Action Plan on Financing Sustainable Growth, there remain concerns regarding the quality of corporate sustainability information and whether it can be more effectively utilised to support the objectives of the European Green Deal and the transition to a sustainable economy.

This paper reviews the conceptual and practical problems associated with the corporate-centric approach to provision of sustainability information. It highlights that the exclusive focus on data users from the financial sector can be problematic as it precludes other stakeholders such as national or sub-national public institutions that have a critical role in the transition toward a sustainable economy (e.g. ministries, municipalities, regional planning bureaus etc.) from effectively utilising the disclosed information.

The paper then outlines how georeferenced sustainability information can help to address these issues. One key benefit relates to the possibility of linking disclosed data with existing datasets from public institutions. Such interlinkages would allow for better data validation, benchmarking of performance against more contextualised (and meaningful) indicators and thresholds and identification of missing data. A further key benefit relates to non-finance data users like ministries, municipalities, regional planning bureaus etc. being able to produce data on and govern units that have distinct geographical-administrative boundaries like a municipality, region or nation-state.

Finally the paper elaborates recommendations to increase the utility of corporate sustainability information for these other data users. Given that the corporate-centric approach to disclosure of sustainability information is hard wired into the entire EU regulatory framework, these recommendations do not propose a fundamental rewrite of the substantial number of existing regulations and directives which reflect this principle. Instead the recommendations focus on enhancing the existing regulatory framework to increase the utility of sustainability information which is already provided. They include: (1) integrating a facility for data aggregation into the European Single Access Point; (2) introducing a requirement for georeferencing certain sustainability indicators; (3) exploring how company sustainability information can be integrated with existing administrative and statistical datasets; and (4) conducting a stocktake of use cases and users of sustainability information.

The paper was developed by 2DII in collaboration with Technical University of Munich and LMU Munich under the Green DIA project.

About the Green DIA project: Green Data, Indicators, Algorithms. Connecting Sustainable Finance and Smart Cities (GreenDIA) is an interdisciplinary consortium research project with three partners. The Chair for Land Management (Prof. Walter de Vries, TUM), Chair for Remote Sensing (Prof. Michael Schmitt, Uni BW) and Chair for Data Science & Statistics in the Humanities (Prof. Frauke Kreuter, LMU). It is funded by the Bavarian Research Institute for Digital Transformation (bidt) of the Bavarian Academy of Sciences. More info: https://www.bidt.digital/forschungsprojekt/daten-indikatoren-und-algorithmen-der-nachhaltigkeit-zur-verbindung-von-smart-cities-und-green-finance/

Funded by: