Find out the webinar replay of the Questionnaire presentation by Samia Baadj, Senior Manager, available here.*

*Do not forget to log in to Vimeo so you can see the video.

Depuis août 2022, les institutions financières qui fournissent des conseils financiers et gèrent des portefeuilles en Europe doivent obligatoirement évaluer les préférences de leurs clients ou clients potentiels en matière de développement durable. Les entreprises d’investissement en Europe doivent prendre en compte ces préférences en matière de durabilité dans le processus de sélection des instruments financiers qui sont recommandés à ces clients.

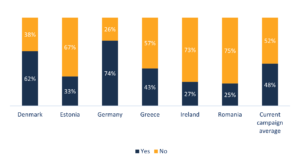

Cependant, la campagne de visites mystères menée par 2DII en 2022 (253 visites dans six pays de l’UE) a révélé un niveau de conformité à la réglementation alarmant. En outre, la campagne a montré que la prise en compte actuelle par les distributeurs de produits financiers des préférences en matière de durabilité est insuffisante, d’une part, pour répondre aux besoins des investisseurs orientés vers l’impact et, d’autre part, pour inclure une quantité appropriée de détails pour le marché.

Rendez-vous au cours desquels le conseiller a abordé le sujet des préférences en matière de durabilité sans aucune incitation.

Ces résultats confirment l’analyse du cadre réglementaire réalisée par 2DII, qui s’inquiétait du fait que l’évaluation des préférences en matière de durabilité conformément à la nouvelle exigence de MiFID II ne permettait pas de savoir si un client est orienté vers l’impact et ne pouvait par conséquent pas aboutir à la recommandation d’un produit financier orienté vers l’impact. Sans intervention, nous nous attendons à une mauvaise vente systémique aux clients intéressés par l’impact (représentant plus de 40% des investisseurs de détail selon le programme de recherche de 2DII sur les préférences en matière de durabilité dans 14 pays de l’UE).

C’est pourquoi l’2DII a élaboré un questionnaire des meilleures pratiques et un guide pour aider les institutions financières à procéder à une évaluation complète des préférences et des motivations d’un client en matière de durabilité. De plus, cela permet de se conformer à la nouvelle réglementation et aux attentes de leurs clients. Ces aspects sont essentiels pour améliorer l’adéquation des produits recommandés, renforcer la confiance des consommateurs et faire en sorte que les marchés financiers contribuent à la réalisation des objectifs sociétaux et environnementaux.

Le Questionnaire et le Guide ont été développés sur une période de plus d’un an par 2DII en prenant en compte (i) le cadre réglementaire pertinent (ii) l’expertise et la recherche de 2DII en relation avec l’évaluation des préférences de durabilité des clients de détail (iii) les discussions d’un groupe de travail français composé d’environ 20 membres (représentants des principales parties prenantes de la finance durable en France, y compris les institutions financières, les ONG et les universitaires) dans le contexte du projet Finance ClimAct et (iv) les commentaires reçus lors d’une consultation publique sur un projet de Questionnaire et le Guide ouverte par 2DII de mars 2022 à juin 2022.

Les documents complets sont disponibles ici :

Annexe I : Documents explicatifs à l’intention des clients

Annexe II : Produits financiers pouvant faire l’objet d’une recommandation

Annexe III : Conseiller les clients orientés vers l’impact

Avec cette publication, 2DII lance une consultation européenne sur le questionnaire et les documents d’orientation jusqu’en avril 2023. Sur la base de ces retours, nous prévoyons de publier une deuxième version en mai 2023.

N’hésitez pas à utiliser cette mini-enquête pour nous faire part de vos commentaires ou à nous contacter directement par e-mail : samia@2degrees-investing.org

À propos de notre bailleur de fonds : Ce projet a reçu un financement du programme LIFE de l’Union européenne dans le cadre de l’accord de subvention LIFE18IPC/FR/000010 A.F.F.A.P. Clause de non-responsabilité : La Commission européenne n’est pas responsable de l’utilisation qui pourrait être faite des informations qu’elle contient.