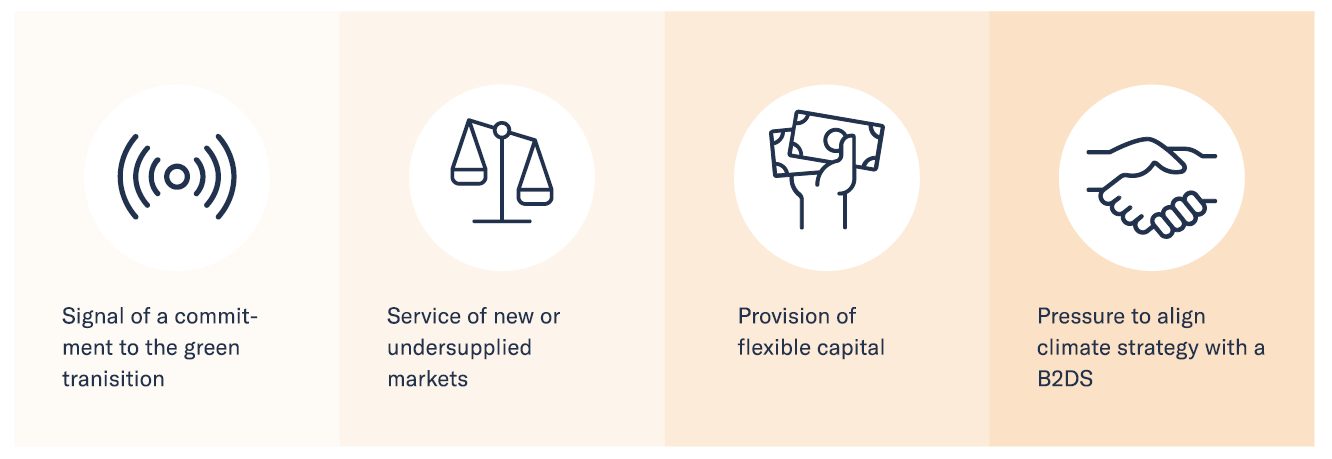

To dive into the impact mechanisms used by green financial products, 2DII developed a Climate Impact Potential Assessment Grid, grounded on previous studies of investor impact by the Impact Management Project and University of Zurich. The grid includes four criteria: 1) signalling a commitment to the green energy transition, 2) servicing new or undersupplied markets, 3) providing flexible capital and 4) pressuring funded organisations to align their climate strategy with a below-2°C scenario.

The Climate Impact Potential Assessment Grid for green financial products

We found that certain mechanisms are associated with higher levels of impact than others. For instance, many new, increasingly popular financial structures, like green bonds or sustainability-linked bonds, target mature companies that already have broad access to financing. As a result, they fail to address some critical funding gaps observed for small companies or small projects.

To remedy this shortfall, the authors call for a number of reforms, such as opening the most popular green structures, especially green bonds, to smaller-scale renewable energy and energy efficiency projects. This could be achieved by pooling risk through securitization and could drastically help households, small municipalities, and SMEs gain access to financing for green projects.

Climate impact potential of financing solutions. Green cells show that the impact mechanism is clearly actioned by the solution, red cells that it is clearly not, and orange cells that it is uncertain or conditional to the features of the financing solution.

More on the study

The report comes as the European Commission has proposed ramping up its greenhouse gas (GHG) emissions reduction target from 40% to at least 55% compared to 1990 levels by 2030, as part of the Climate Target Plan and European Green Deal. A massive reorientation of our economies and financial sectors is needed to reach this goal, including closing a financing gap of 340 billion euros annually for energy efficiency and renewable energy investments.

Meanwhile, financial sector players have developed a number of new schemes to help bridge financing gaps and meet surging demand for greener products from investors. But there is still a lack of tools, evidence and know-how for assessing the impact potential for these products and their ability to support the energy transition.

About our funder: This project is funded by the EU’s Horizon 2020 research and innovation program under Grant Agreement No 894345. This work reflects only the authors’ views, and the funder is not responsible for any use that may be made of the information it contains.