The goal of the CIMS is to help financial institutions design climate strategies for maximum impact on climate change mitigation. It is especially valuable for financial institutions that have undertaken long-term net-zero commitments. The CIMS framework can be applied at the product, business line, or institutional level. While it is primarily designed for financial institutions, it can also inform the development of labelling or certification schemes for financial products. It is key to notice that the CIMS framework is also a useful tool to design transition plans.

The impact of a financial institution to diminish adverse effect of climate change is measured by the extent to which its actions lead to observable changes in reducing GHG emissions. To effectively guide FIs in this direction, two prominent frameworks are in place: the CIMS and the Glasgow Financial Alliance for Net Zero (GFANZ) target-setting guidelines. Both are designed with a common objective: to help FIs maximize their impact on mitigating climate change by focusing on the reduction of real-world emissions and have the ambition to serve as a blueprint for future regulation. These frameworks are not only tools for current climate strategy enhancement but also aim to set precedents for future regulatory standards in climate change mitigation.

In this paper, 2DII cross-analyses CIMS with one of the GFANZ methodologies, specifically the Net Zero Banking Alliance (NZBA) methodologies. Thus, 2DII intends to:

- Target the Net Zero alliances follow-up and synthesize their net-zero commitments, comparing the mechanisms they used with the Climate Impact Management System’s mechanisms, and drawing recommendations based on this analysis;

- Analyze whether these methodologies actually cross-fertilize each other in the sense of overarching alignment and impact strategies, which could in turn advocate the financial institutions in the design of climate strategies; and,

- Conclude as to the interoperability of CIMS and net-zero methodologies.

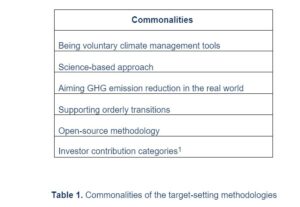

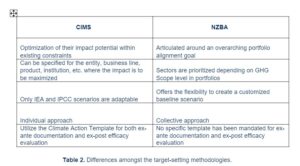

The NZBA target-setting guidelines and the CIMS framework share many overlapping elements, some of which are enumerated in Table 1 below. These commonalities constitute a solid foundation for potential convergence and cross-fertilization of the two approaches. Both methodologies are considered voluntary environmental tools for financial institutions to evaluate, disclose, and improve their environmental performances, while also striving to align with the Paris Agreement’s goals, targeting significant climate action by 2030 and aiming for broader goals by 2050. It is crucial to note that, there are no binding rules for investors to implement alignment methodologies on their portfolios.

CIMS and NZBA support financial institutions in refining their targets, utilizing scientific approaches that consider the pursued objectives and required actions. While NZBA aims at driving impact through collective actions of FIs, CIMS more individually facilitates GHG emissions reduction in the real world through impactful actions in the financial institutions’ client relationships, products, and services. These methodologies are designed to include categories of similar climate actions such as engagement, exclusion, divestment, etc. However, given their open-source nature, there has been room for other action types to accommodate in the frameworks. Over time, these features can expand and diversify.

Building on the insights derived from this cross analysis, the following recommendations are underscored:

- The need for regulatory uptake of impact target-setting frameworks,

- CIMS can be used as an operationalization tool for net-zero commitments,

- CIMS can be recognized as a supporting tool to implement credible transition plans,

- CIMS can help FIs calibrating their communication to avoid impact-washing and enhance transparency.

FUNDING: This project was funded by the European Union LIFE program under the grant agreement LIFE18IPC/FR/000010 A.F.F.A.P.

DISCLAIMER: This work reflects the views of 2DII. The other members of the Finance ClimAct Consortium and the European Commission are not responsible for the use that could be made of the information it contains.

[1] IMP (2019), A Guide to Classifying the Impact of an Investment.