Client preferences for sustainable investment are increasing and financial advisors take account of these client preferences is a key means to help reorient finance towards a sustainable economy.

Our 2022 mystery shopping campaign (253 visits across six EU countries) was designed to assess advisor behaviour in the context of new regulatory requirements under MiFID II to assess sustainability preferences which came into force in August 2022.

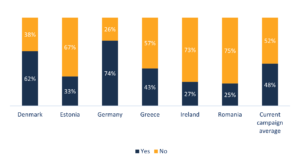

The results reveal an alarmingly low level of regulatory compliance and that harmonization of market practices has not yet been achieved. In only 48% of appointments did the advisor bring up the subject of sustainability preferences without any prompting by the client. The variability in advisor behaviour observed in our previous 2021 mystery shopping campaign has continued despite these regulatory changes.

Appointments where the advisor raised the subject of sustainability preferences without any prompting

The results also show that in average 39% of the advisor did not assess the minimum proportion to be invested in accordance with sustainability preferences.[1] In addition, the majority of advisors failed with record keeping obligation – both in relation to the initial identification of sustainability preferences and whether the client decides to adapt its sustainability preferences. These procedural steps are the key mechanism to creating the incentives for financial institutions to provide more sustainable financial products over time.

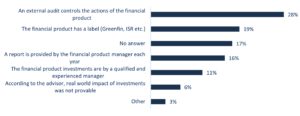

Furthermore, our visits underline that the existing definition and integration of sustainable preferences are insufficient to accommodate impact-oriented investors (while impact is for 40% of retail investors a key motivation to invest sustainably based on our previous study in the target countries). Advisors have a significant lack of knowledge on investor impact and the level of knowledge is stagnating compared to our 2021 results. Eventually, our preliminary analysis of recommended products indicate, that they are unsuitable for impact-oriented clients. This creates a systemic risk of mis selling and significantly undermines the objective of the Action Plan on Financing Sustainable Growth.

Advisor explanations of demonstration of the impact of any investment

The fact that many mystery shoppers did not articulate concerns about the level of sustainable finance knowledge of the advisor is inconsistent with other results which reveal low levels of regulatory compliance generally. Based on these results, we expect a low level of competence of retail investors to identify misleading and noncompliant behaviour by their advisors.

These results are cause for concern about the operability of the retail focussed aspects of the regulatory framework. We articulate three recommendations to improve the operability of the regulatory framework and ensure that the financial sector responds appropriately to client preferences for sustainable investment:

To counter this poor advisor behaviour, 2DII has developed a Questionnaire and Guidance for assessing client sustainability preferences and motivations (publication on February 23, 2023) setting out what we consider to be good practice for a comprehensive assessment of both sustainability preferences and wider sustainability motivations and a methodology for matching financial product features to sustainability preferences and wider sustainability motivations.

About our funders: This project is part of the Retail Investing Research Program at 2DII and has received funding from EIT Climate-KIC. The project is co-funded by the European Climate Initiative (EUKI) from a project together with WWF Greece and the Czech Consumer Organization. EUKI is a project financing instrument by the German Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU). The EUKI competition for project ideas is implemented by the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH. It is the overarching goal of the EUKI to foster climate cooperation within the European Union (EU) in order to mitigate greenhouse gas emissions.

[1] Assessing the minimum proportion is necessary for sustainability preferences sub-paragraph (a) and (b).