The COP26 Finance Sector Expert Group for Race to Zero and Race to Resilience (FSEG), established by the High-Level Climate Champions, have published a new discussion paper, “How Can Net Zero Finance Best Drive Positive Impact in the Real Economy”.

Read the paper here.

The discussion paper highlights the need for net zero targets and performance metrics to explicitly distinguish ‘alignment’ from impact generation. Specifically, it highlights three types of measurement approaches designed to better distinguish real world impact from virtual emissions reductions as a result of portfolio reallocation. These are:

- Rebaselining of emissions / alignment disclosures to distinguish ‘virtual’ changes from real world outcomes;

- Disclosure of primary vs. secondary market transactions to better understand the extent to which direct financing is provided;

- Full disclosures of the universe of climate actions and impact case studies to better understand actions taken by the financial institution to realize impact outcomes and to inform academic research on the topic.

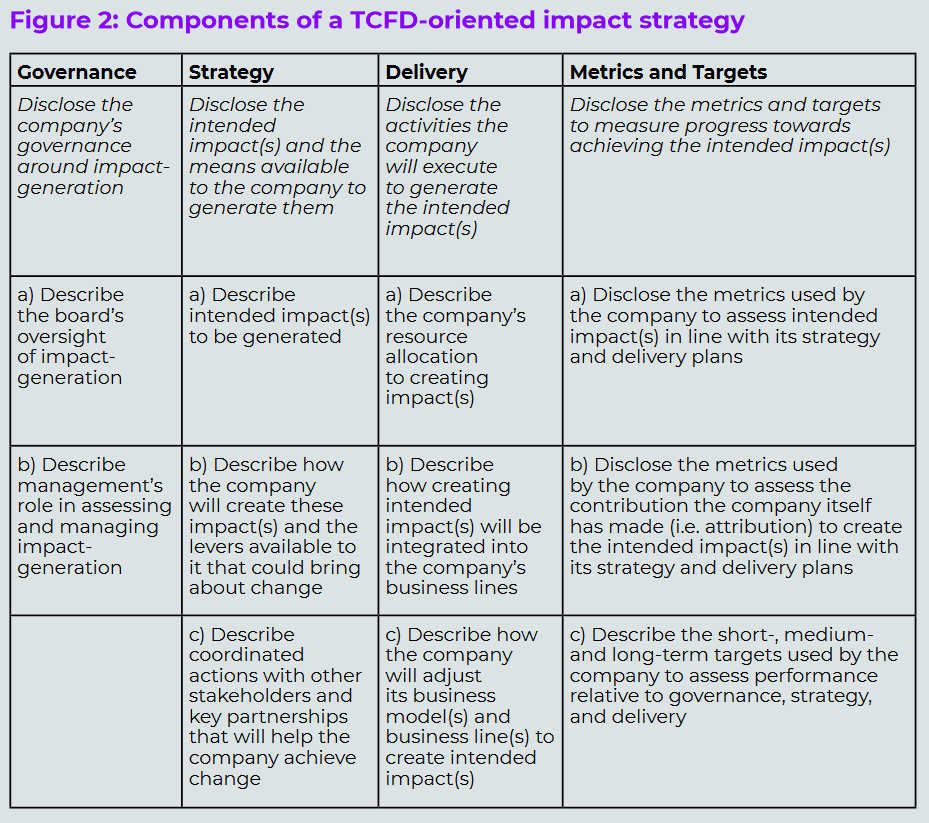

The paper develops a framework of impact management and highlights 2° Investing Initiative’s (2DII) Climate Impact Management System as an approach to getting started on the impact journey. 2DII’s research has highlighted the urgency of financial institutions’ disclosures to align with GHG Protocol Scope 3 guidance that requires rebaselining. In separate research, a review of PCAF disclosures shows that despite PCAF guidance requiring that financial institutions disclose their rebaselining approach, less than 5% of 50 reviewed PCAF disclosures make a reference to the issue in their disclosures.

The discussion paper is open for consultation until June 30, 2022.

About our funders: 2DII’s work on this paper has received funding from the European Climate Foundation.

Disclaimer: The views expressed in this paper represent those of the authors and do not necessarily represent those of the Finance Sector Expert Group for Race to Zero and Race to Resilience, UN High-Level Champions for Climate Action, or other institutions or funders. The paper is intended to promote discussion and to provide public access to results emerging from our work.