It establishes a common set of rules on how asset managers and other financial market players need to disclose the sustainability characteristics of their investments. Until now, financial institutions have been relatively free to sell a variety of different investment products as so-called “green” products with little oversight and under a patchwork of different criteria.

The SFDR’s main objective is to “strengthen protection for end investors and improve disclosures to them” (Recital 35). The text comes as regulators and supervisors are boosting their oversight of financial institutions in order to combat greenwashing (or misleading claims related to financial products’ environmental credentials).

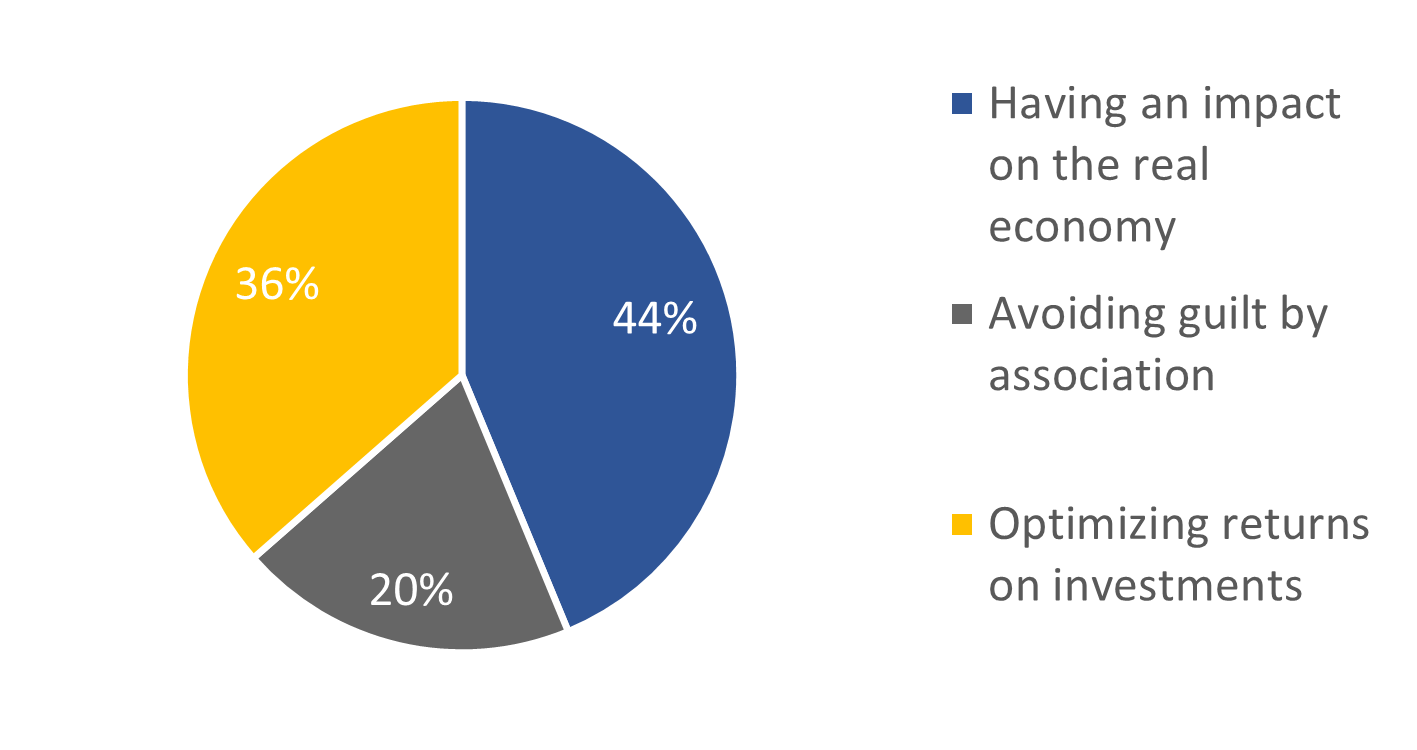

What would best describe your motivation for products taking into account environmental criteria?

Figure 1. Motivation of retail investors for taking environmental criteria into account (Source: 2DII, 2020).

This, in turn, means it’s critical to examine how well impact products are captured by the SFDR, in order to judge whether the regulation will really meet its stated objectives.

What’s impact for a financial institution?

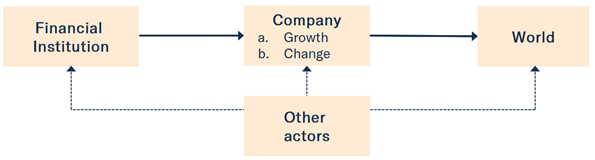

The term “impact” is tossed around frequently in financial circles, but it’s worth taking a step back to define what it is – and isn’t. Technically, the impact of a financial institution or product on the world is the change caused by this institution or product in the world – often in the activities of companies it is invested in or financing. Figure 2 below illustrates this idea.

Figure 2. A synthetic definition of FI impact (Authors, based on Kölbel et al., 2018; Caldecott, 2020; Brest & Born, 2013)

Under this definition, there are two crucial concepts:

- Causality: For the financial institution to get credit for impact, it needs to have caused a change in the activities of real economy actors, i.e. it needs to have brought about a change that wouldn’t have occurred without its intervention.

- Distinction between financial institution and company impact: The impact of the financial institution is the share of the company’s impact that it has caused. Companies’ impact can be much larger than that caused by any one financial institution. Therefore, the impact of the financial institution is simply the part of the companies’ impact that it caused, and the financial institution cannot get credit for impact that it did not cause.

How do the SFDR product categories accommodate notions of impact?

So now the question is, how well does the SFDR accommodate these two pillars of impact (the notion of causality and the distinction between financial institution and company impact)?

On one hand, it seems that one of the SFDR’s goals is to differentiate impact products from non-impact products. The recitals state:

“(…) it is necessary to distinguish between the requirements for financial products which promote environmental or social characteristics and those for financial products which have as an objective a positive impact on the environment and society.”

However, the provisions’ actual drafting does not achieve this differentiation. Article 9 of the SFDR applies to financial products having sustainable investment as an objective. Meanwhile, “sustainable investment” is defined in the regulation as meaning “an investment in an economic activity that contributes to an environmental objective”.

Therefore, the drafting of Article 9 merely refers to “investing in an economic activity that has a positive impact”. As such, it fails to consider the causality angle, i.e. what role – if any – the FI may have played in bringing about this positive impact. What’s more, it fails to preserve the distinction between financial institution impact and company impact.

For sustainability-minded retail investors, then, the SFDR product categorisation caters to those who want to “get exposure to sustainable growth” and “avoid guilt by association” (See Figure 1). However, impact-focused retail investors are left wanting. As a result, we believe that the SFDR will not enable the conditions for genuine impact products to grow and worse, current market practices may result in mis-selling non-impact financial products to these retail investors. Such consequences of the newly enforced regulations are already visible, with various FIs equating their self-classified Article 9 products with impact products in marketing materials.

It’s likely that the market won’t cater to these impact-focused retail investors until the SFDR introduces an additional category of financial products, which differentiates genuine impact products from other sustainability-focused financial products.

In the meantime, we recommend that financial institutions remain cautious when communicating on the impact of their self-classified Article 9 products, bearing in mind the difference between being exposed to sustainable companies (Article 9) and having an impact on those companies (genuine impact products).