The objective of this historic Framework is to halt the catastrophic decline of the world’s biodiversity. It aims to do so by protecting 30% of the world’s surface and by restoring at least 30% of its ecosystems. (3) The agreement is built around four goals: (A) Restoration of ecosystems; (B) Sustainable use of biodiversity; (C) Utilisation and sharing of genetic resources; and (D) Implementation, access and sharing of technologies to fully implement the Framework. The goals are accompanied by 23 action-orientated targets that need to be initiated immediately by States. (4)

The finance sector has an essential part to play, and the Kunming-Montreal Framework is relying on its mobilisation to fulfil its goals and targets. The objective of the Framework is to mobilise US$200 billion annually by 2030 from domestic, international, public, and private resources. (5) The Framework stresses the need for developed countries to increase aid, towards least developed countries and developing countries, to US$20 billion per year by 2025, and to at least US$30 billion by 2030.

As well as financing, the Framework pushes for the optimisation of co-benefits and synergies for finance targeting the biodiversity and climate change. It also underlines the importance of specialised financial tools such as green bonds, biodiversity offsets and credits. In the same manner as the UNEP FI program, the Framework encourages public and private parties to further develop blended finance options, especially for undersupplied markets. Such public/private partnerships are recognised as one of the most effective ways to get the private sector to invest, either in infrastructure projects or through impact funds and other instruments.

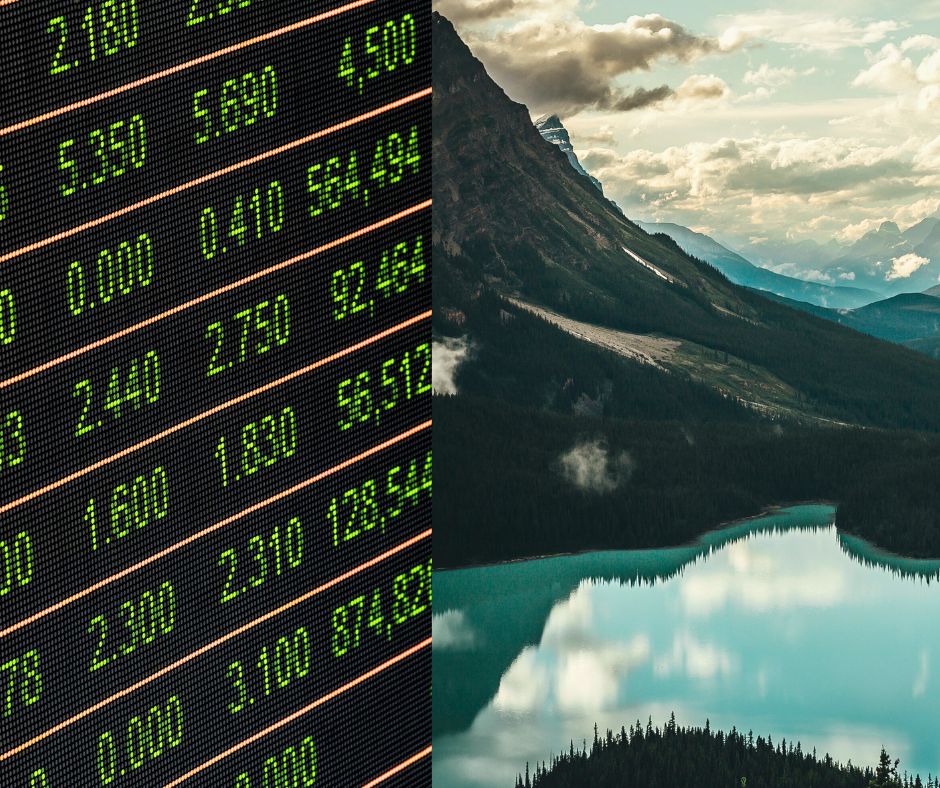

With worldwide biodiversity in a critical state, the Kunming-Montreal Global Biodiversity Framework recognises the crucial role of the finance sector and is a call to action.

[1] Kunming-Montreal Global biodiversity framework, December 2022 [2] Le Monde, COP15 : à Montréal, des engagements historiques pour la biodiversité, 19 December 2022 [3] Ibid [4] Kunming-Montreal Global biodiversity framework, December 2022 [5] Kunming-Montreal Global biodiversity framework, Target 19