Impact has risen to the top of the sustainable finance agenda, as shown by the theme of Climate Finance Day 2021. Meanwhile, a growing number of financial sector initiatives are announcing new climate-related targets or strategies in the run-up to COP26, which in turn has placed strong emphasis on finance.

But many of these commitments have set targets that are decades in the future, with little detail on the near-term actions that will be undertaken to meet them. Additionally, we still have limited understanding of these initiatives’ impact – whether they have actually contributed to reducing greenhouse gas emissions in the real economy.

The newly finalized Climate Impact Management System fills this gap, providing FIs with clear guidelines to devise, refine, and communicate about impactful climate strategies. The system was developed by Sustainable Finance Observatory (formerly 2DII) and the French Ecological Transition Agency (ADEME) and incorporates feedback from global financial institutions that was received during the consultation period earlier this year.

More on the Climate Impact Management System

The goal of the system is to help financial institutions design climate strategies for maximum impact on climate change mitigation. It is especially valuable for financial institutions that have undertaken long-term Net Zero commitments and want to set up near-term plans to actively contribute to these commitments. The framework can be applied at the product, business line, or institutional level. While it is primarily designed for financial institutions, it can also inform the development of labelling or certification schemes for financial products.

The Climate Impact Management System builds on existing standards and frameworks, such as the ISO Standards 14097 and 14001, the Eco-Management and Audit Scheme (EMAS), and the Impact Management Project’s framework, and references various tools and guidance documents that can further assist FIs in setting up evidence-based climate strategies.

How it works

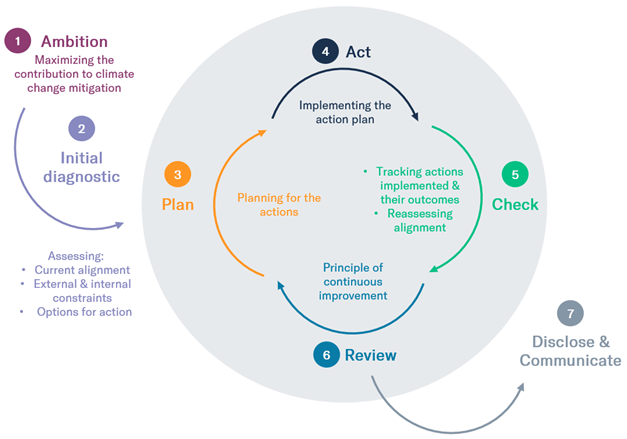

The Climate Impact Management System consists of several steps, per the graphic below.

- Defining the ambition of the climate impact strategy to be developed

- Undertaking an initial diagnostic to assess your portfolios’ alignment and implemented actions

- Identifying and planning impact targets, at both the contribution and outcome level

- Implementing the plan

- Monitoring and tracking the plan’s implementation

- Revising and improving the plan

- Communicating about the strategy and actions taken

Access the system here. We welcome additional pilot testers from the financial industry. If you or your institution are interested, please contact souad at 2degrees-investing.org.

About our funders: This project has received funding from the European Union’s LIFE program under grant agreement LIFE18IPC/FR/000010 A.F.F.A.P.

Disclaimer: This work reflects only the views of Sustainable Finance Observatory (formerly 2DII) and ADEME. Other members of the Finance ClimAct consortium and the funders are not responsible for any use that may be made of the information it contains.

Meanwhile, policymakers are increasingly exploring how regulation can help align finance with climate goals. Much of the success of these efforts is measured by the ability of financial institutions to ‘decarbonize their portfolios’ or ‘align their portfolios with climate goals’ in some form, independent of the extent to which this leads to decarbonization in the real economy. While alignment is a valuable strategy for many purposes, such as risk management, its effectiveness in causing decarbonization in the real economy is debatable and conditional. This is where the Climate Impact Management System comes in: helping FIs bridge the gap between alignment and impact, committing to align their portfolios with the Paris Agreement alongside a commitment to help reduce greenhouse gas emissions in the real economy. More on 2DII’s thinking.

Why might your savings be funding fossil fuels?

Why might your savings be funding fossil fuels?