More than 150 Swiss investors, including some of the country’s biggest banks, insurances, and pension funds, have now signed up to test the climate alignment of their portfolios with the PACTA scenario analysis methodology – representing a new milestone in global uptake of the tool.

The assessments come in the context of the PACTA 2020 project, part of a multilateral initiative coordinated by the Swiss and Dutch governments to measure the alignment of public and private investment portfolios with climate goals. The Swiss/Dutch initiative was launched at the 2019 UN Climate Action Summit in New York. A number of other EU countries, including Denmark, Italy, Liechtenstein, Luxembourg, Norway, Portugal, Spain, and Sweden, have since signed onto the initiative. In addition to Switzerland, assessments have already begun in Liechtenstein, Sweden, and Austria, and are scheduled to begin in Norway this fall.

2° Investing Initiative has been providing key support to this initiative, offering participating governments and financial institutions early access to an enhanced version of the PACTA climate scenario analysis methodology.

A banner year for uptake of the PACTA methodology

In addition to 2DII’s support for the PACTA 2020 initiative, the first half of 2020 also marked new milestones in uptake of the PACTA methodology by international investors, banks, governments, regulators, and other institutions.

As of June 2020, 3,000+ individuals from more than 1,800 institutions have used PACTA to conduct over 12,000 tests, with an average of 600+ tests per month. Altogether, over 1,500 FIs with more than USD 106 trillion in total AuM have used the methodology, with users from 90+ countries and six continents.

The full figures and case studies of usage are available in the dedicated PACTA brochure.

New partnerships and head of PACTA

This year, 2DII will also partner with other leading sustainable finance institutions to strengthen its climate scenario analysis expertise, notably Carbon Tracker Initiative (CTI) and Rocky Mountain Institute. As announced last month, 2DII’s collaboration with CTI will provide an integrated climate scenario analysis solution for financial institutions and companies, based on their existing and upcoming research capabilities.

In addition, 2DII will collaborate with Rocky Mountain Institute, a leading global energy research institute, through their Center for Climate-Aligned Finance, to develop standardized impact measurement frameworks and methodologies to help drive climate alignment in the financial sector.

Finally, in mid-August, we look forward to welcoming Maarten Vleeschhouwer as our first Head of PACTA. He is joining us from the European Commission’s DG FISMA, where he is a seconded national expert assisting in the implementation of the Commission Action Plan on Financing Sustainable Growth. He has additional experience at the Dutch National Bank, which was one of the first central banks to use the PACTA scenario analysis tool.

About our funders: PACTA has received financial support from the European Union’s Life programme under LIFE Action grant No. GIC/FR/00061 PACTA. PACTA has also received funding from the International Climate Initiative (IKI). The Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU) supports this initiative on the basis of a decision adopted by the German Bundestag. The funders are not responsible for any use that may be made of the PACTA tool and/or any information contained in this newsletter.

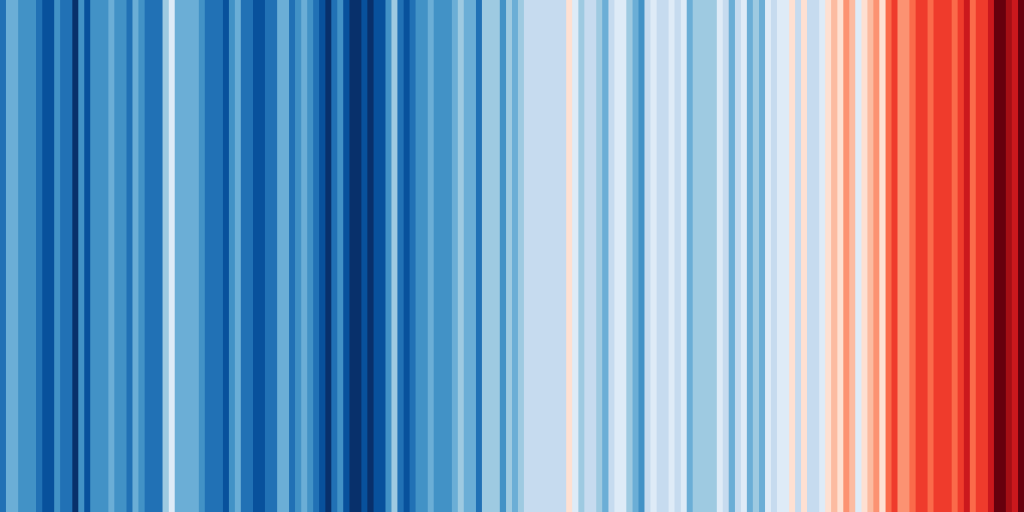

Photo credit: “Warming stripes” by Ed Hawkins (University of Reading)