2º Investing Initiative is proud to announce a suite of improvements to the Paris Agreement Capital Transition Assessment (PACTA) tool. For the first time, investors can now analyze multiple portfolios simultaneously, save their results online, and receive interactive results on their alignment with the Paris climate goals (view a sample report here). They can also use PACTA to comply with existing and upcoming disclosure rules, such as the TCFD and EU Sustainable Finance Disclosure Regulation, which entered into force on March 10th.

Also available is the beta version of 2DII’s Climate Action Guide, an educational tool for financial institutions to learn more about impact (provide feedback on the Climate Action Guide via our survey – open until March 21st).

Try out the new tool here.

More about PACTA:

PACTA is a free, open-source methodology and tool that measures the alignment of corporate bonds, loans, and listed equities with international climate objectives such as the Paris Agreement. Since its launch in 2018, PACTA for Investors has been used by over 4,500 individuals from over 3,000 institutions around the globe. On average, PACTA is applied to more than 600 portfolios each month, for a total of over 18,000 tests thus far.

In September 2020, PACTA for Banks was launched following 12+ months of road-testing in partnership with 17 leading banks (including ING, BNP Paribas, Citi, and more). Six of these banks, known as the Katowice Commitment banks, have committed to actively steering their portfolios in line with the Paris Agreement, relying in part on PACTA.

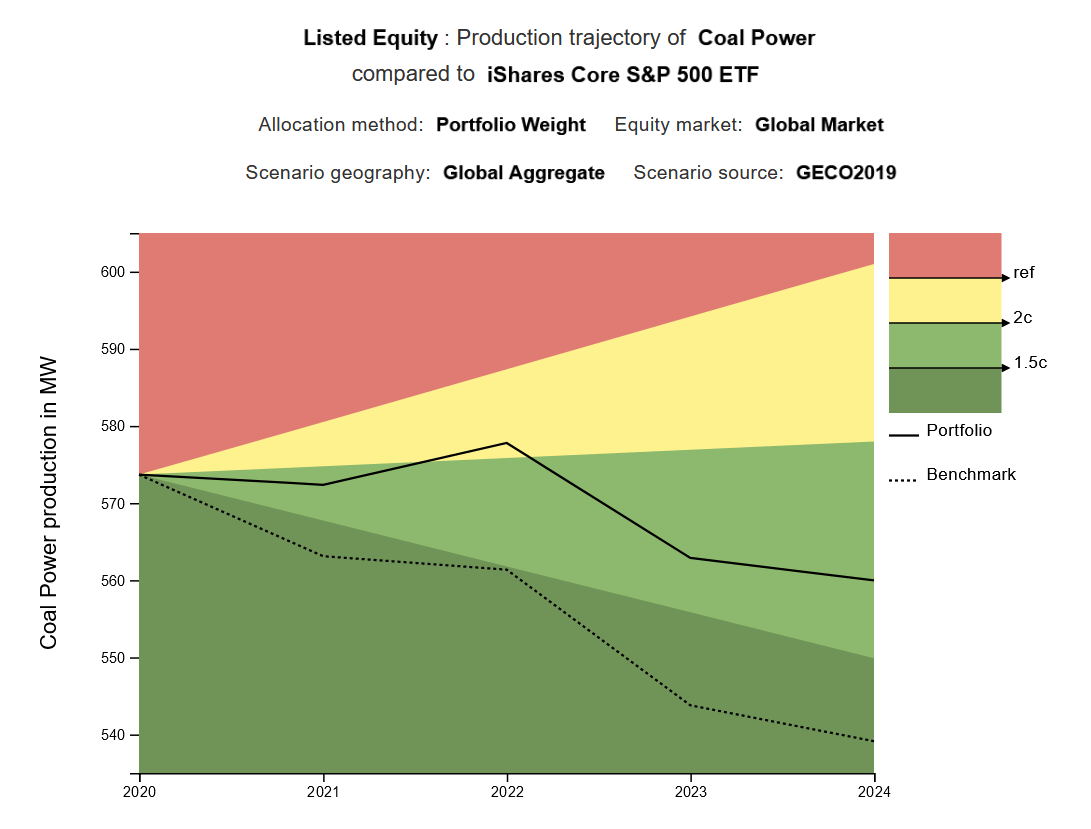

Below: a screenshot from the new, interactive PACTA tool

PACTA was deliberately designed not to compete with commercial tools, but rather to help reduce transaction costs, facilitate joint efforts to measure Paris alignment, and improve coordination of collective exercises by governments, supervisors, and regulators.

To this end, PACTA has been used by a number of supervisors to carry out stress-testing and measure the climate alignment of their regulated entities, including the Bank of England, Dutch National Bank, and California Department of Insurance. Several European governments, including Switzerland, Austria, and more, are also participating in organized, national-level climate assessments as part of PACTA Coordinated Projects.

Helping FIs meet requirements under the TCFD, new EU disclosure regulations, and more

Critically, the upgraded PACTA tool will help enable financial institutions to respond to growing legal and societal pressure to incorporate climate-related considerations into their investment decisions.

On March 10th, alongside existing recommendations by the Taskforce on Climate-Related Finance Disclosures (TCFD), the EU Sustainable Finance Disclosure Regulation (SFDR) came into effect. This far-reaching regulation requires EU financial institutions to disclose sustainability-related information at both entity- and product-level, as well as details on sustainability risks. Additionally, under the upcoming EU Taxonomy Regulation slated for 2022, many financial institutions will be required to disclose whether and to what extent their products invest in “green” activities.

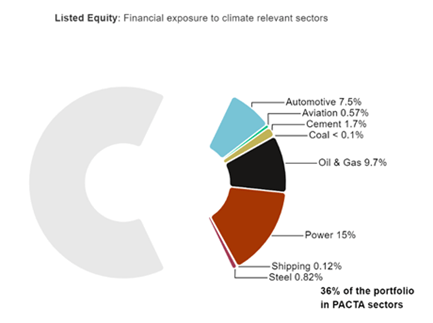

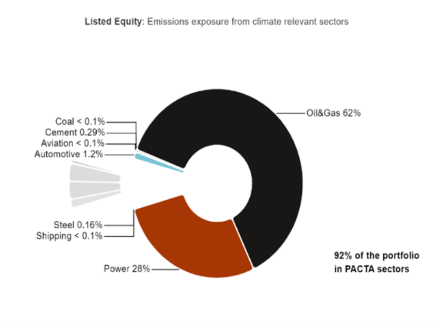

PACTA can help financial institutions proactively integrate existing and upcoming requirements into their business processes. For instance, when it comes to the SFDR, PACTA allows investors to get a granular view of their exposure and alignment in eight climate-critical sectors, thereby helping them manage and be transparent about adverse sustainability impact and sustainability risks.

Comparing the graphs below emphasizes the importance of the eight sectors in terms of climate relevance. While making up 36% of a random portfolio´s value, they are responsible for 92% of the equity portfolio’s estimated CO2 emissions.

Read our guide on PACTA and disclosure regulations

About our funders:

This project is part of the International Climate Initiative (IKI). The Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU) supports this initiative on the basis of a decision adopted by the German Bundestag.

This project has also received funding from the ClimateWorks Foundation; the Swiss Environment Ministry; and European Union’s Life NGO program under Grant No LIFE18/NGO/SGA/FR/200020.