The Paris Agreement Strategy & Taxonomy Assessment project will develop a climate-related database covering at least 200,000 SMEs across Europe

The global, non-profit think tank 2° Investing Initiative (2DII) has launched a new project to develop a climate database on SMEs, to help financial institutions and supervisors obtain more precise company-level risk and sustainability information. The three-year, €1 million project is funded among others by the EU LIFE Programme and supported by several major international banks, including ING, Société Générale, and BBVA. The data developed by this project will also inform a stress testing exercise by a large G20 central bank in 2022.

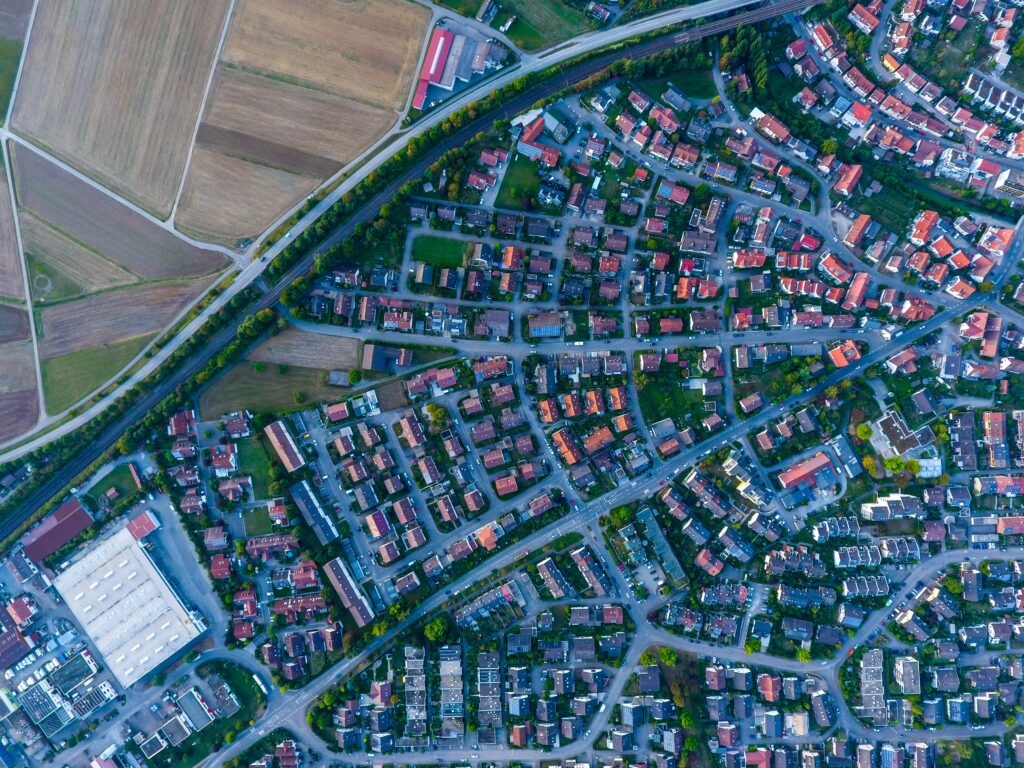

Operationally, the project will develop an open-source, climate-related database covering at least 200,000 SMEs across the European Union by 2022. The aim is to encompass at least half of all European mid-sized companies, expanding to 1 million SMEs across Europe as well as 1 million SMEs internationally by the end of the project (subject to further funding). The project is part of 2DII’s long-term risk and supervision program, 1in1000.

More on the project and key benefits

For each company, the database will provide an individual physical and transition risk score, based on the geolocation of the firm’s assets, supply chain information, products and service portfolio, and other public data. It will include a set of tailored datapoints on each SME to help financial institutions, supervisors and central banks create risk and sustainability profiles for individual companies. The project will also develop a set of guides that allow data users to understand specific engagement opportunities related to SMEs, as part of their lending criteria and client engagements.

The database will therefore enable banks to meaningfully integrate climate change risk and opportunity considerations into their SME lending portfolios. Additionally, it will allow financial supervisors and central banks to better understand climate risks across a broader set of banking activities. By bringing public data to the market, it also will help further reduce the transaction costs of climate action in financial markets.

Notably, the project will build off the technical capabilities 2DII has gained by developing the PACTA methodology, which relies on global physical asset-level data as the core analytical concept. This provides granular, regional, sector-specific, forward-looking production pathways that can be compared with various scenarios. As always, consistent with its mission as a non-profit, 2DII will make all outputs from this project free, open-source and publicly available.

Questions? Please email transitionmonitor at 2degrees-investing.org or banks at 2degrees-investing.org for banks.

About our funder: We are grateful to our funder, the EU LIFE Programme, for its support. This content expresses the views of 2DII only, and the funders and partners are not responsible for any use that may be made of the information it contains.